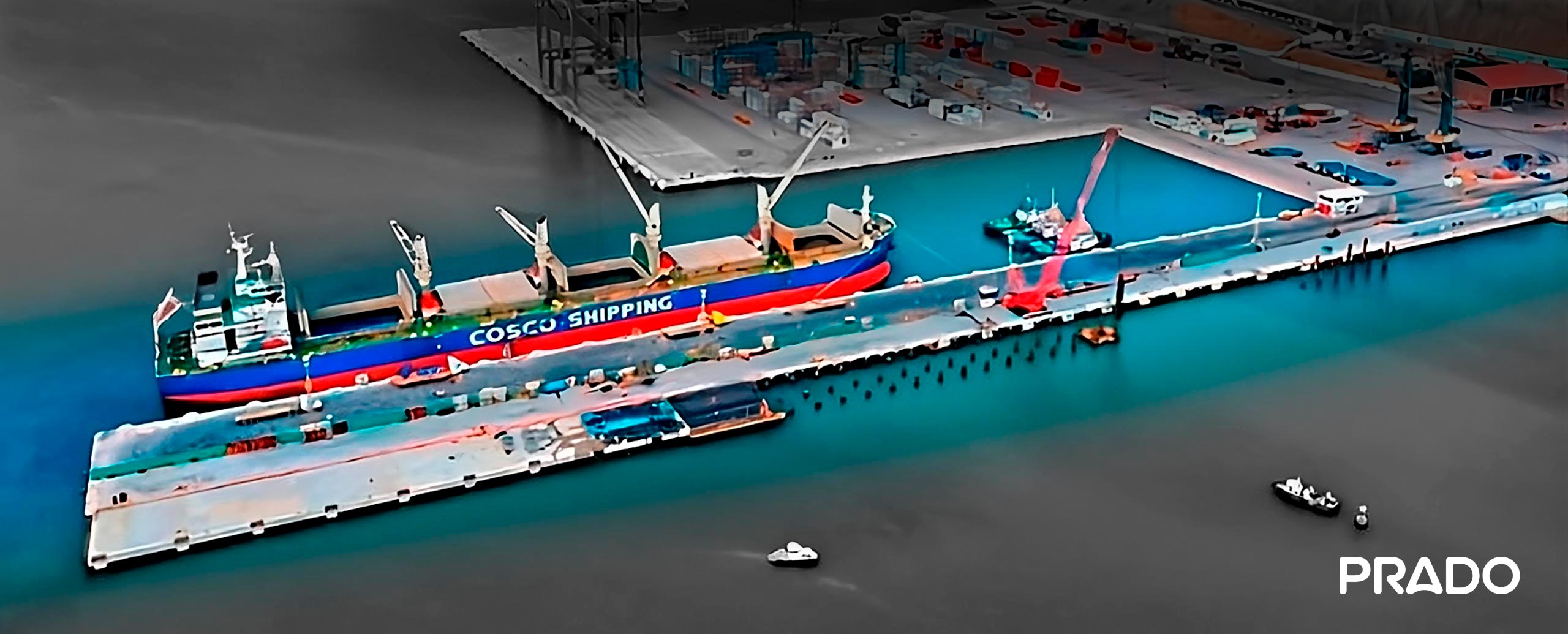

Port of Chancay and the FTA with China

The inauguration of the Port of Chancay — ranked as the most important port terminal in the South Pacific — along with the expansion of the Free Trade Agreement (FTA) between China and Peru, marks a turning point for several economic sectors, including the insurance industry. This mega-project, with an initial investment of US$1.3 billion, will not only boost international trade, but also create significant opportunities to promote and diversify the country’s insurance offering.

» The Chancay megaproject will not only boost international trade, but also create significant opportunities to promote and diversify the country’s insurance offering. «

One of the areas poised for significant growth is transportation and logistics insurance. As a strategic logistics hub, Chancay will drive greater demand for coverage to protect maritime, land, and air cargo, considering risks such as damage, loss of goods, and natural disasters. Likewise, the increased volume of commercial operations could encourage the adoption of specialized infrastructure insurance, including coverage for construction, operation, and maintenance risks, as well as cyber insurance to safeguard advanced port management technologies.

International trade is also emerging as a key driver of insurance market expansion. Exporting and importing companies that benefit from the enhanced FTA will require policies tailored to commercial, financial, and customs risks. In this context, trade credit and contractual compliance insurance are positioned as essential products to mitigate the risks inherent in global business.

Likewise, occupational accidents and diseases remain a significant challenge in our country. The primary goal of occupational risk prevention is to protect workers from the hazards inherent in their job activities. Therefore, in light of the high incidence rates and the importance of promoting actions and measures to minimize or eliminate the causes of occupational accidents and illnesses, we provide you with the comprehensive regulations and current legislation on risk prevention.

As the port attracts new industries and businesses, property and liability insurance will play a crucial role. Companies establishing operations in the region will need to protect both their facilities and their liability to third parties. This environment also paves the way for designing flexible, modular insurance products tailored to the specific needs of each business.

Digitization

For the insurance sector, these opportunities also bring challenges—chief among them, the need for digitalization. The FTA provisions that facilitate data transfers could be leveraged to develop online insurance platforms, streamlining the purchase, management, and claims processes. Additionally, joint efforts between the public and private sectors are essential to promote insurance uptake, particularly among small and medium-sized enterprises looking to enter global trade.

Training

Training and awareness will be key to driving the development of the insurance sector. Educating companies about the strategic benefits of having adequate insurance will enable them to integrate these tools as an essential part of their risk management strategies. These efforts will not only help boost the insurance market, but also strengthen Peru’s competitiveness, preparing it to meet the challenges of international trade.

Conclusion:

The consolidation of Chancay as a logistics hub and the growing trade relationship with China not only transform the Peruvian economy, but also create fertile ground for modernizing and expanding the insurance market, positioning it as a strategic ally of national development.

Ensure the protection of your organization.

For further information, kindly contact a PRADO representative.